Printable Blank 1099 Form

Printable Blank 1099 Form - Fill in the empty areas; Buy now and receive instantly. Download this 2022 excel template. Web instructions for recipient recipient’s taxpayer identification number (tin). Web box 2a) withheld for state, city, or local tax department $ copy b box 2a) withheld report this income on your federal tax return. Use this universal 1099 blank tax form to file a. Check out our guides & examples for different. Complete, edit or print tax forms instantly. Web instructions for recipient recipient’s taxpayer identification number (tin). If this form shows federal income tax withheld in. For filing and furnishing instructions,. Web instructions for recipient recipient’s taxpayer identification number (tin). Starting at $59 for unlimited w2 1099 filing. Web instructions for recipient recipient's taxpayer identification number (tin). In addition to this, the website provides printable. Starting at $59 for unlimited w2 1099 filing. Fill, edit, sign, download & print. Web the irs 1099 tax form printable is a mandatory document for various individuals and businesses who have received income other than salary or wages during the financial. Payments above a specified dollar threshold for rents,. Married filing jointly returns, if someone can claim your spouse. Check out our guides & examples for different. Use this universal 1099 blank tax form to file a. Web processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. The form requires the filer to provide. Web instructions for recipient recipient’s taxpayer identification number (tin). Enjoy great deals and discounts on an array of products from various brands. Ad make office life easier with efficient recordkeeping supported by appropriate forms. Use this universal 1099 blank tax form to file a. For your protection, this form may show only the last four digits of your social security number. Download this 2022 excel template. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount. Must be submitted to recipients and irs by january 31st. Web instructions for recipient recipient’s taxpayer identification number (tin). Ad get the latest 1099 misc online. Fill in. Web with a blank 1099 form for 2022 printable on our website, users can fill out their information directly and conveniently. Download the 1099 tax form in pdf or complete the editable template online. For your protection, this form may show only the last four digits of your social security number. Buy now and receive instantly. Payments above a specified. Starting at $59 for unlimited w2 1099 filing. Web instructions for recipient recipient’s taxpayer identification number (tin). Download this 2022 excel template. Web instructions for recipient recipient’s taxpayer identification number (tin). Web with a blank 1099 form for 2022 printable on our website, users can fill out their information directly and conveniently. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount. Buy now and receive instantly. If this form shows federal income tax withheld in. Download the 1099 tax form in pdf or complete the editable template online. Web. For your protection, this form may show only the last four digits of your social security number. For your protection, this form may show only the last four digits of your social security number. Download this 2022 excel template. Web get irs 1099 form to report an annual income in 2023. Fill in the empty areas; Web with a blank 1099 form for 2022 printable on our website, users can fill out their information directly and conveniently. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount. For your protection, this form may show. Web get irs 1099 form to report an annual income in 2023. For your protection, this form may show only the last four digits of your social security number. For filing and furnishing instructions,. Do not miss the deadline Must be submitted to recipients and irs by january 31st. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount. Web instructions for recipient recipient’s taxpayer identification number (tin). Download the 1099 tax form in pdf or complete the editable template online. Starting at $59 for unlimited w2 1099 filing. Web instructions for recipient recipient’s taxpayer identification number (tin). For your protection, this form may show only the last four digits of your social security number. Web instructions for recipient recipient's taxpayer identification number (tin). The form requires the filer to provide. Complete, edit or print tax forms instantly. Fill in the empty areas; Web box 2a) withheld for state, city, or local tax department $ copy b box 2a) withheld report this income on your federal tax return. Download this 2022 excel template. Web to calculate and print to irs 1099 forms with their unconventional spacing. Involved parties names, places of residence and phone numbers. Fill, edit, sign, download & print.1099 Div Form Fillable and Editable PDF Template

Downloadable 1099 Tax forms Irs Tax forms 1099 A Federal Copy A 1099

2021 Form IRS 1099NECFill Online, Printable, Fillable, Blank pdfFiller

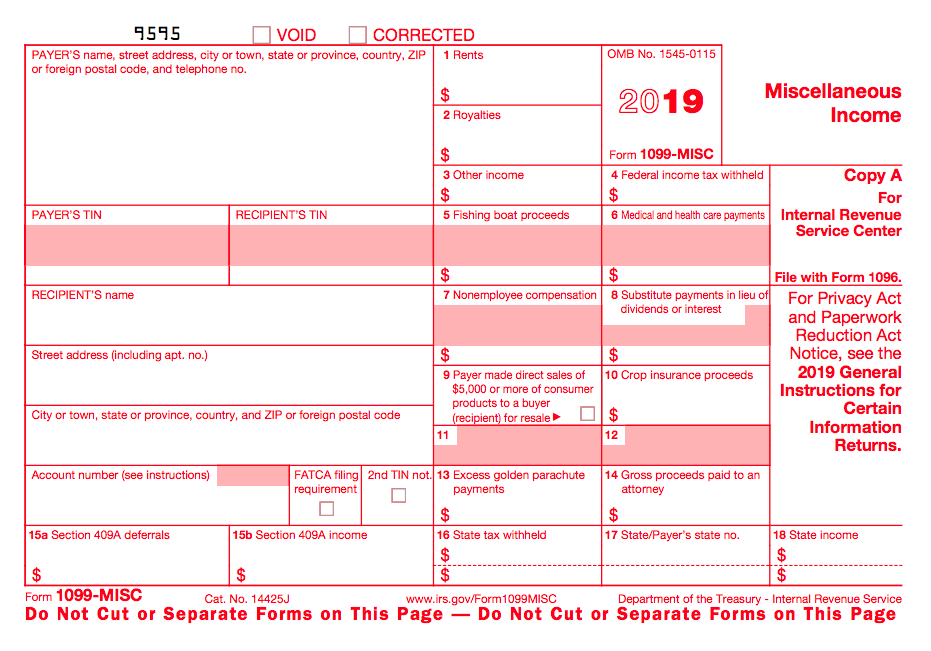

1099MISC Form Printable and Fillable PDF Template

Blank 1099 Form Online eSign Genie

What Is a 1099 Form, and How Do I Fill It Out? Bench Accounting

Form 1099MISC Miscellaneous Definition

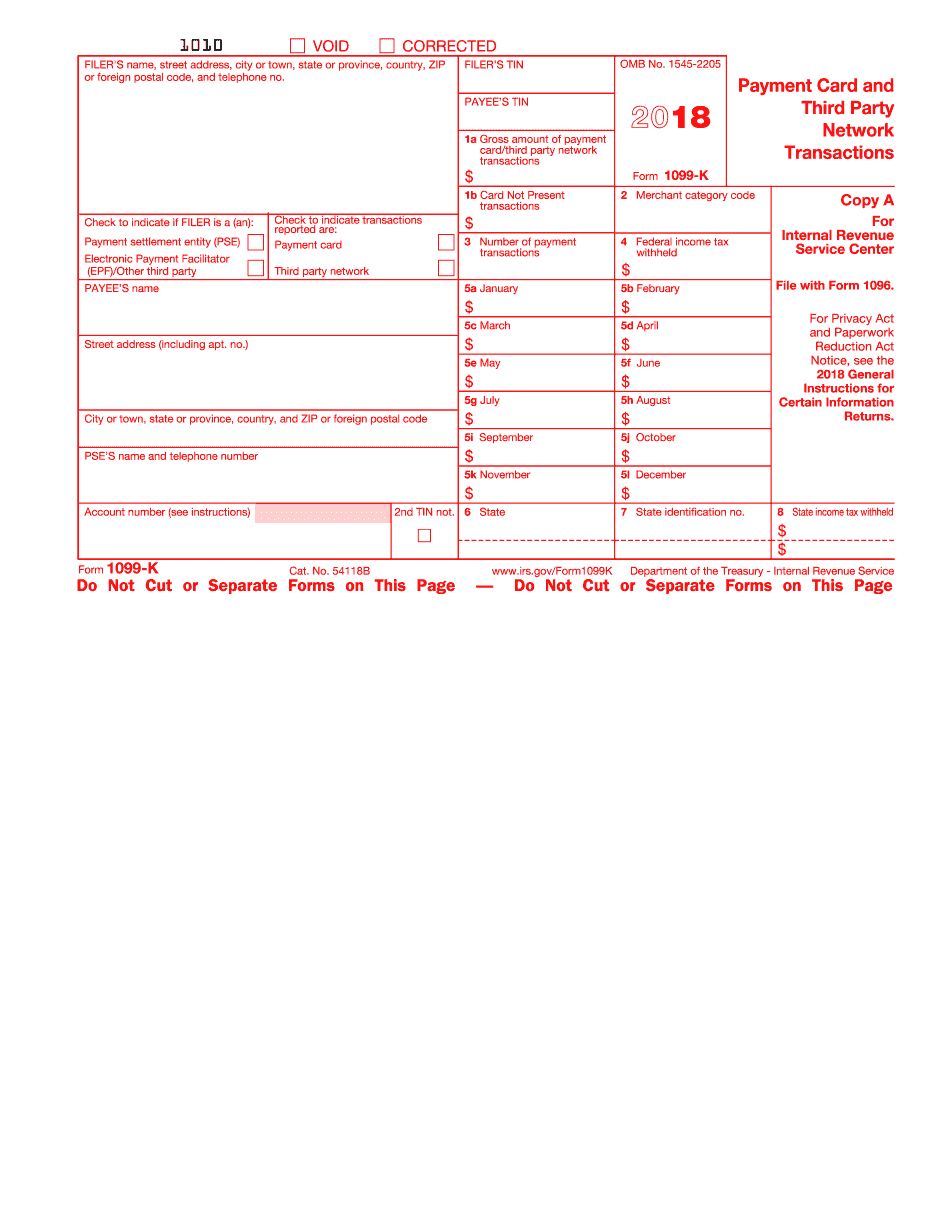

Form 1099K Fill Online, Printable, Fillable Blank

Blank 1099 Forms 2017 Form Resume Examples pv9wovp97A

Form 1099div 20192023 Fill online, Printable, Fillable Blank

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)