Printable 1098 Form

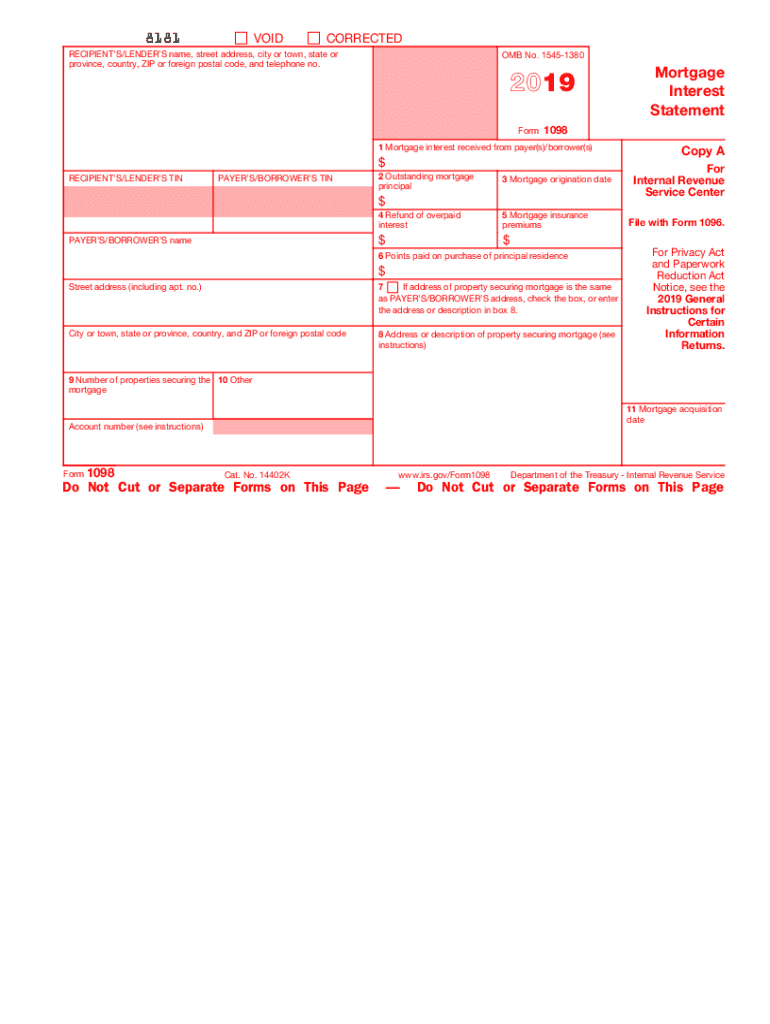

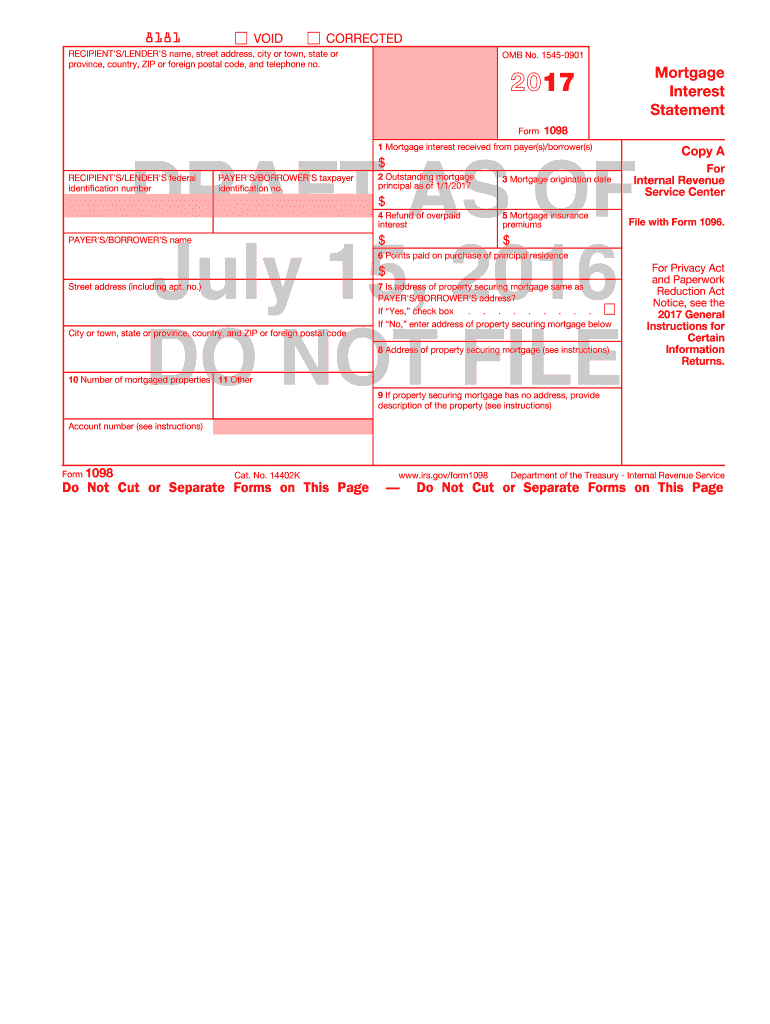

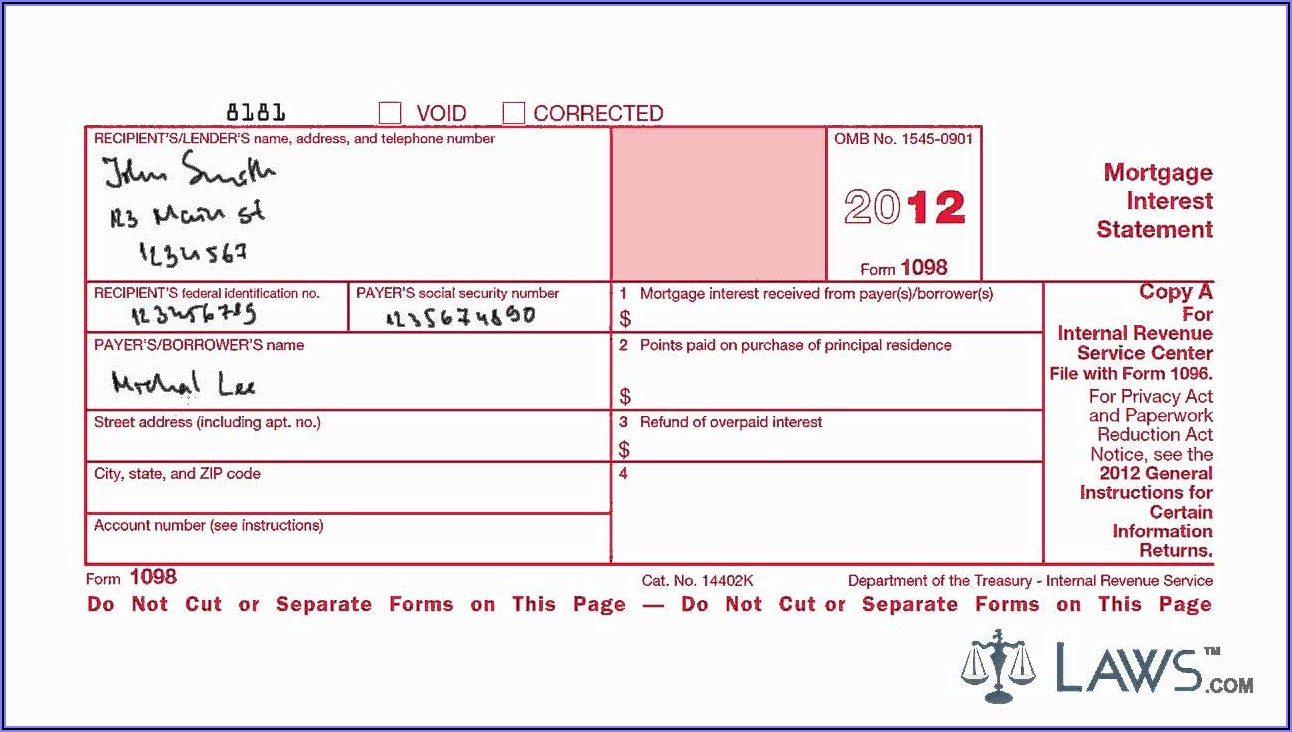

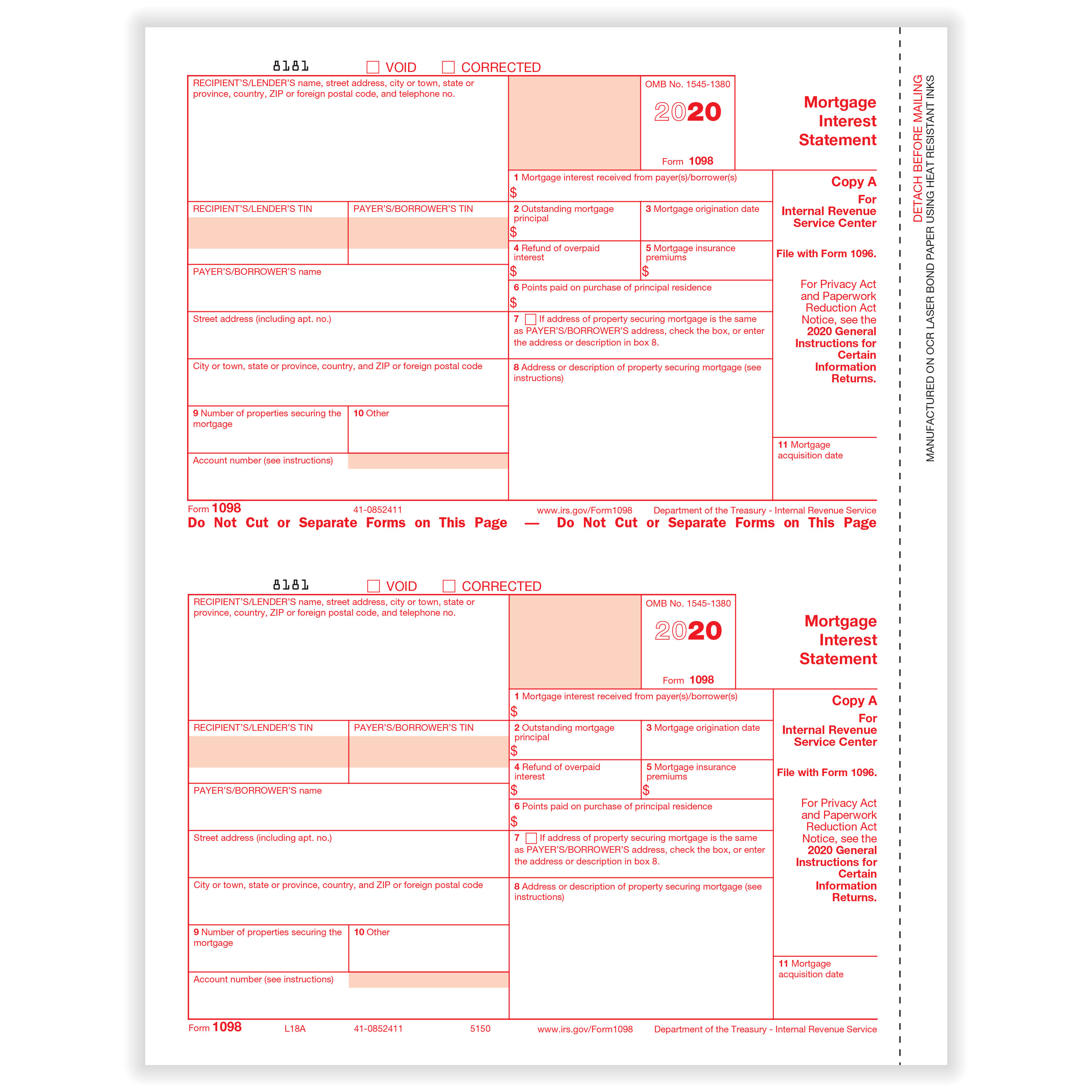

Printable 1098 Form - Web blank 1098 consists of two parts: Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Ad find the 2022 federal tax forms you need. Make office life easier with efficient recordkeeping supported by appropriate forms. For filing and furnishing instructions, including due dates, and to request. This form is for income earned in tax year 2022, with tax returns due in april. In the first one, enter. Web irs 1098 form printable fill now mortgage interest statement a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage. Click on the fillable fields and include the required information. Ad enjoy great deals and discounts on an array of products from various brands. Discover why freetaxusa is the best deal in tax preparation! If you made federal student loan payments in 2022, you may be eligible to deduct a portion of the interest you paid on your 2022. This form is for income earned in tax year 2022, with tax returns due in april. Web the form 1098—also known as mortgage interest statement—is. Web up to $40 cash back easily complete a printable irs 1098 form 2022 online. Click on the fillable fields and include the required information. Web irs 1098 form printable fill now mortgage interest statement a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage. Your tax form will be available. The right side has 9 boxes. Ad find the 2022 federal tax forms you need. Web irs 1098 form printable fill now mortgage interest statement a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921,. Ad enjoy great deals and discounts on an array of products from various brands. Web 1098, 1099, 3921, or 5498 that you download and print from the irs website. Fill in the info required in irs 1098, making use of fillable lines. Create a blank & editable 1098 form,. Web we last updated federal form 1098 in february 2023 from. Web 1098, 1099, 3921, or 5498 that you download and print from the irs website. Web the form 1098—also known as mortgage interest statement—is used to report the amount of interest and related expenses you paid on your mortgage during the tax year. Web irs 1098 form printable fill now mortgage interest statement a mortgage interest statement or form 1098. This form is for income earned in tax year 2022, with tax returns due in april. Ad enjoy great deals and discounts on an array of products from various brands. Web open the file in our advanced pdf editor. In the first one, enter. Web irs 1098 form printable fill now mortgage interest statement a mortgage interest statement or form. Web the form 1098—also known as mortgage interest statement—is used to report the amount of interest and related expenses you paid on your mortgage during the tax year. If you made federal student loan payments in 2022, you may be eligible to deduct a portion of the interest you paid on your 2022. The left part provides information about lenders. For internal revenue service center. Insert graphics, crosses, check and text boxes, if needed. Web we last updated federal form 1098 in february 2023 from the federal internal revenue service. Create a blank & editable 1098 form,. Fill in the info required in irs 1098, making use of fillable lines. 3921, 3922, or 5498 that you print. This form is for income earned in tax year 2022, with tax returns due in april. For filing and furnishing instructions, including due dates, and to request. Ad enjoy great deals and discounts on an array of products from various brands. Your tax form will be available to download by january 31, 2023. Fill in the info required in irs 1098, making use of fillable lines. In the first one, enter. Web 1098, 1099, 3921, or 5498 that you download and print from the irs website. Web we last updated federal form 1098 in february 2023 from the federal internal revenue service. Web irs 1098 form printable fill now mortgage interest statement a. For filing and furnishing instructions, including due dates, and to request. Ad enjoy great deals and discounts on an array of products from various brands. Insert graphics, crosses, check and text boxes, if needed. Web up to $40 cash back easily complete a printable irs 1098 form 2022 online. Ad find the 2022 federal tax forms you need. If you made federal student loan payments in 2022, you may be eligible to deduct a portion of the interest you paid on your 2022. Make office life easier with efficient recordkeeping supported by appropriate forms. Web open the document in our online editor. Get ready for this year's tax season quickly and safely with pdffiller! Your tax form will be available to download by january 31, 2023. The right side has 9 boxes. Web get your 2022 mortgage interest statement (form 1098) online from freedom mortgage. Web we last updated federal form 1098 in february 2023 from the federal internal revenue service. Web open the file in our advanced pdf editor. This form is for income earned in tax year 2022, with tax returns due in april. For internal revenue service center. Create a blank & editable 1098 form,. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, 3922, or 5498 that you print from the irs website. Web the form 1098—also known as mortgage interest statement—is used to report the amount of interest and related expenses you paid on your mortgage during the tax year. Easy lookup to find the form you're looking for.Form 1098 Mortgage Interest Statement Definition

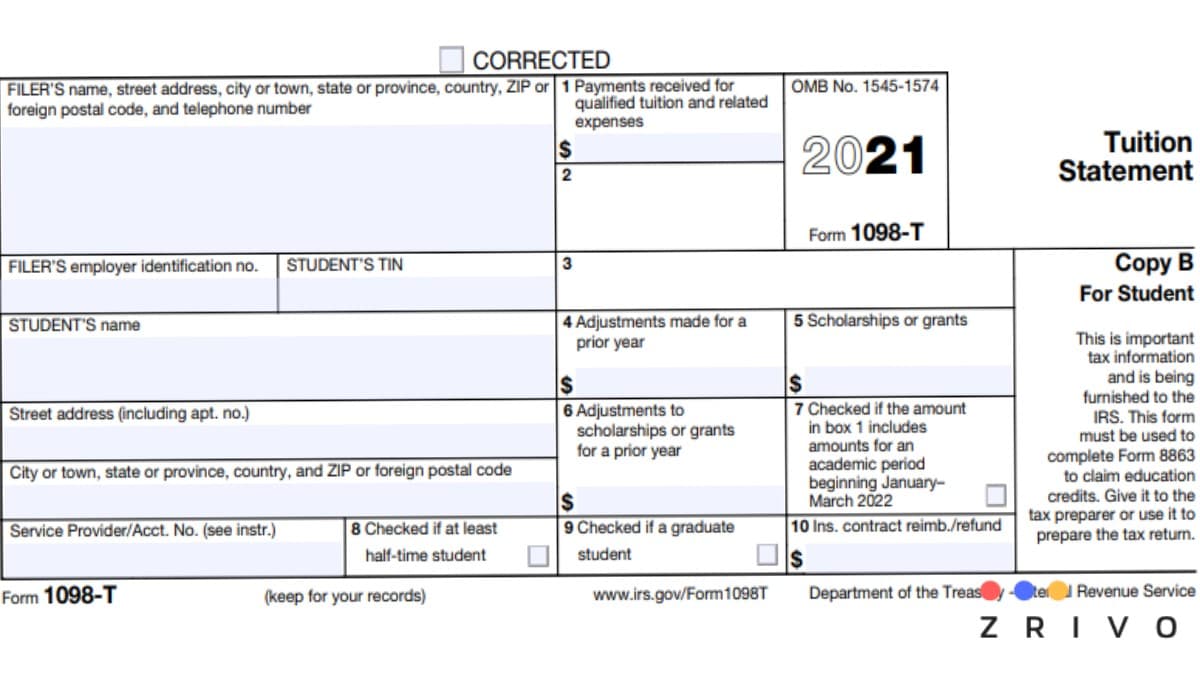

Understanding your IRS Form 1098T Student Billing

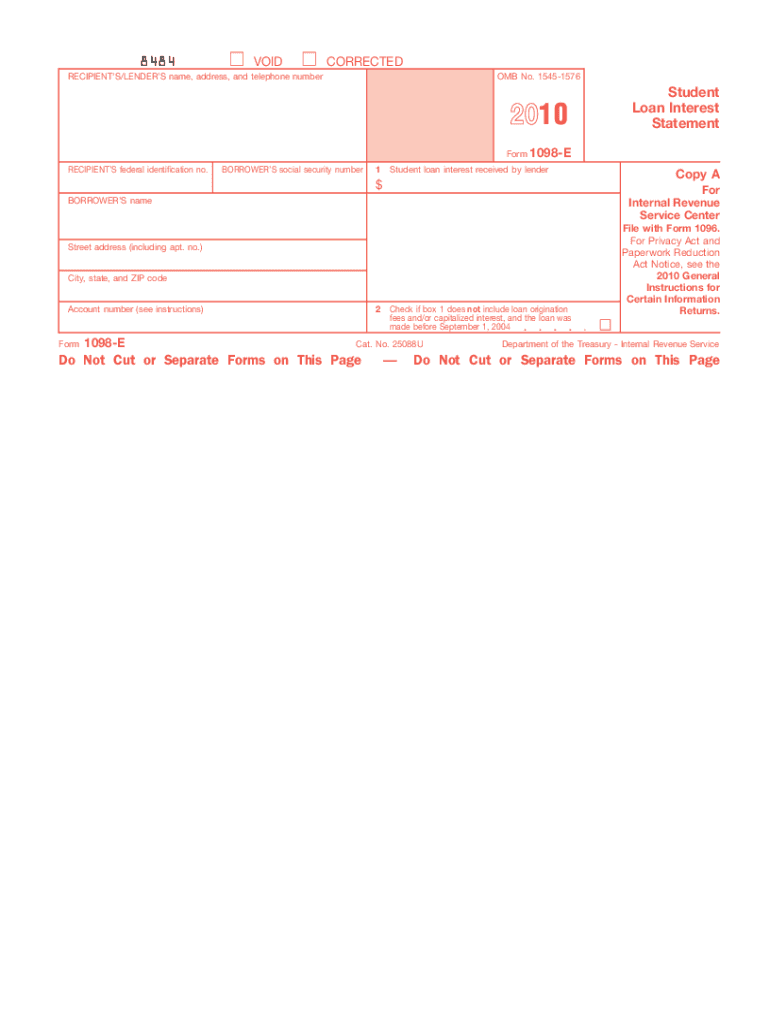

IRS 1098E 20202022 Fill out Tax Template Online US Legal Forms

1098T Form 2023

Form 1098 Mortgage Interest 2019 Fill Out and Sign Printable PDF

Mortgage interest form 1098 changes 2016 Fill out & sign online DocHub

Free Printable 1098 Form Printable Templates

1098 Mortgage Interest Federal 1098 Tax Forms Formstax

1098 Int Form Editable Fill Out and Sign Printable PDF Template signNow

1098T Information Bursar's Office Office of Finance UTHSC

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png)