Montana W 4 Printable

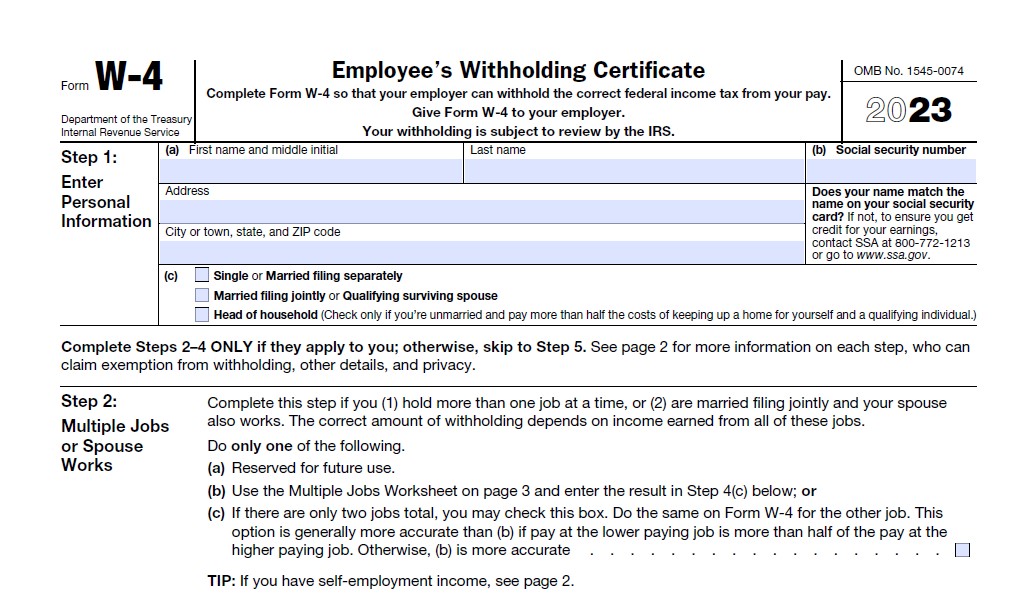

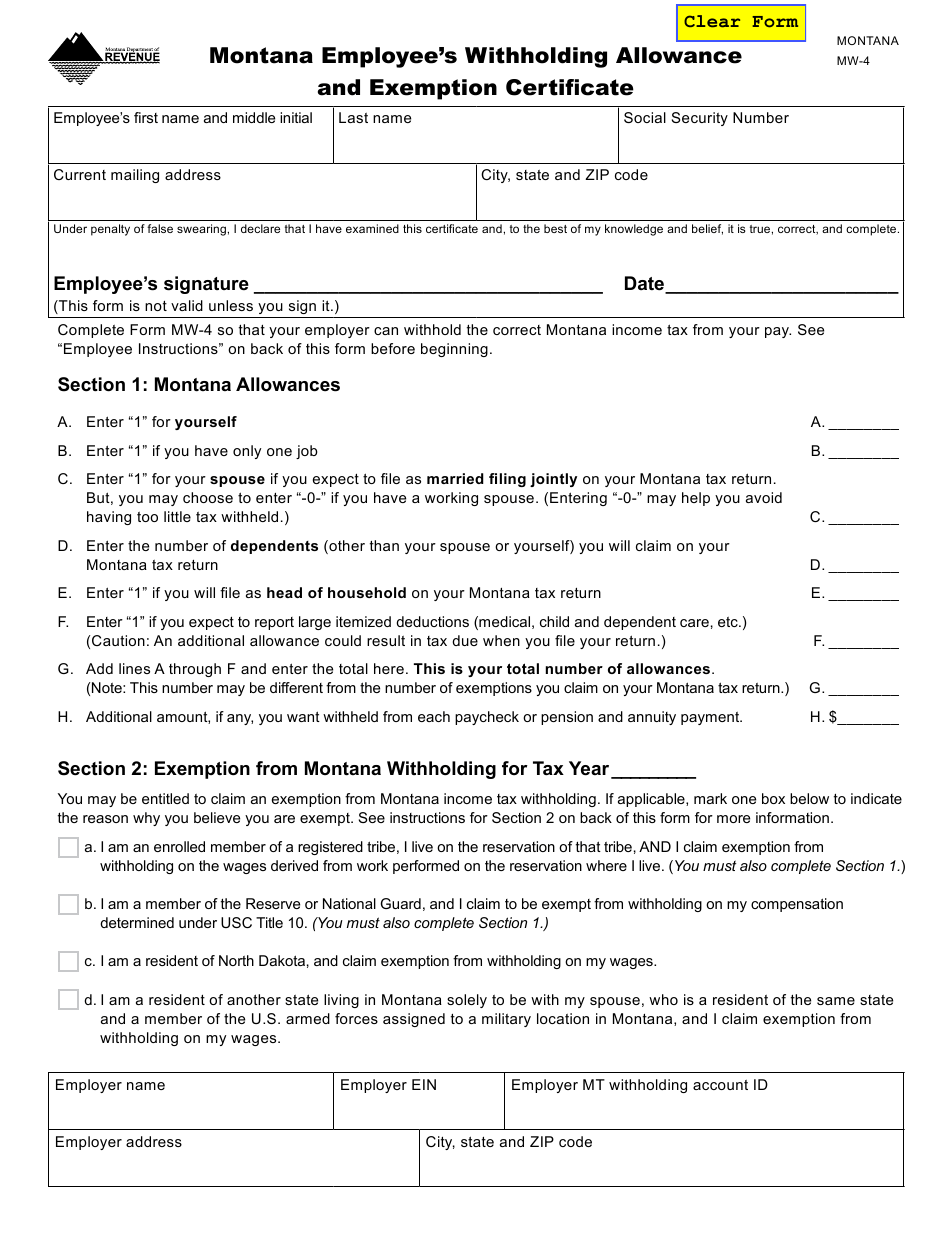

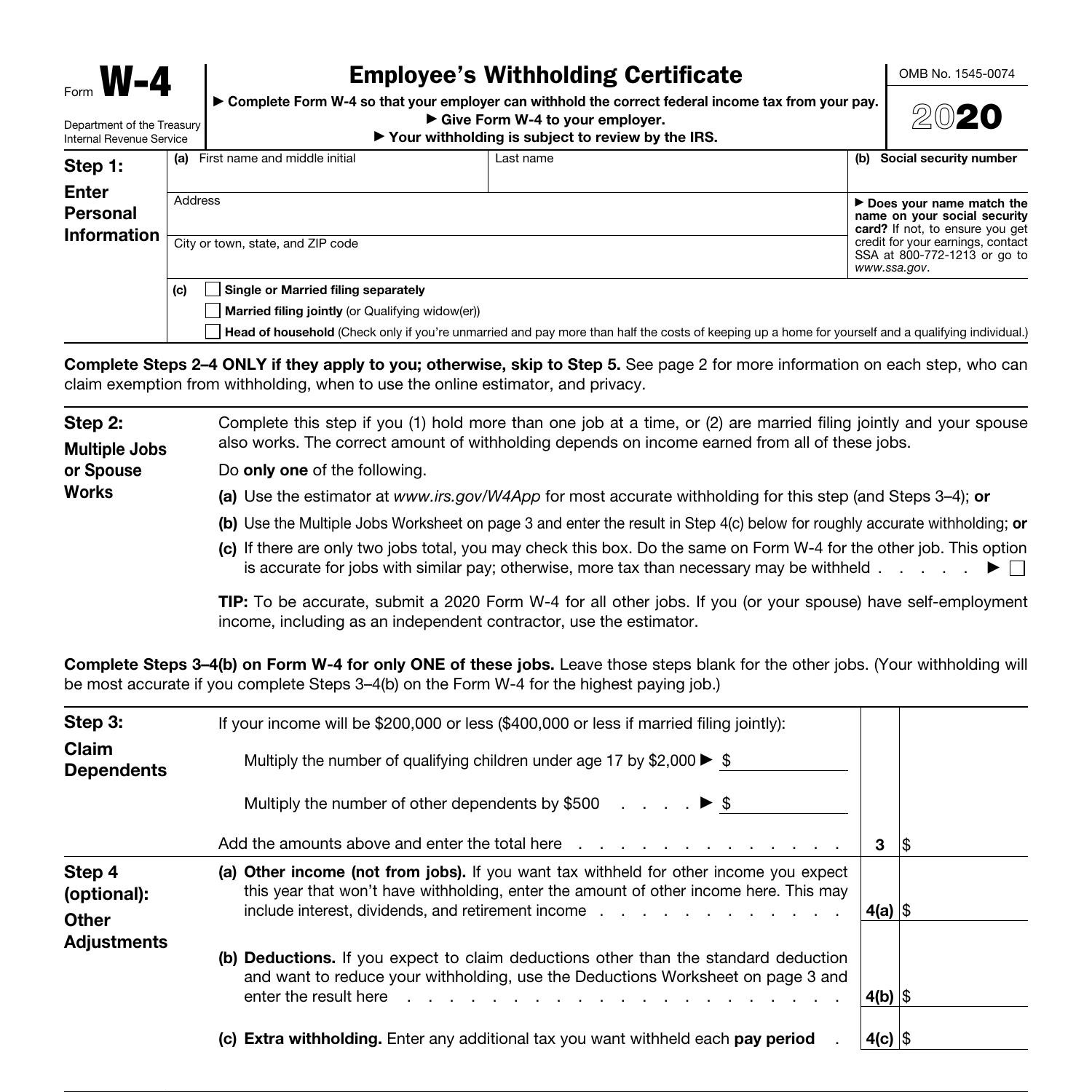

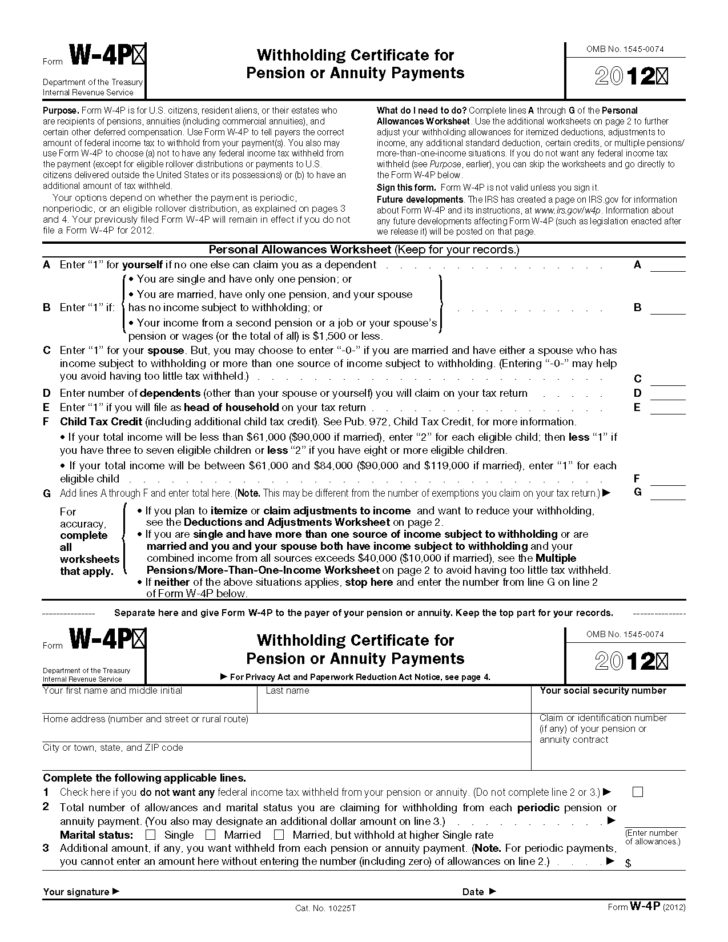

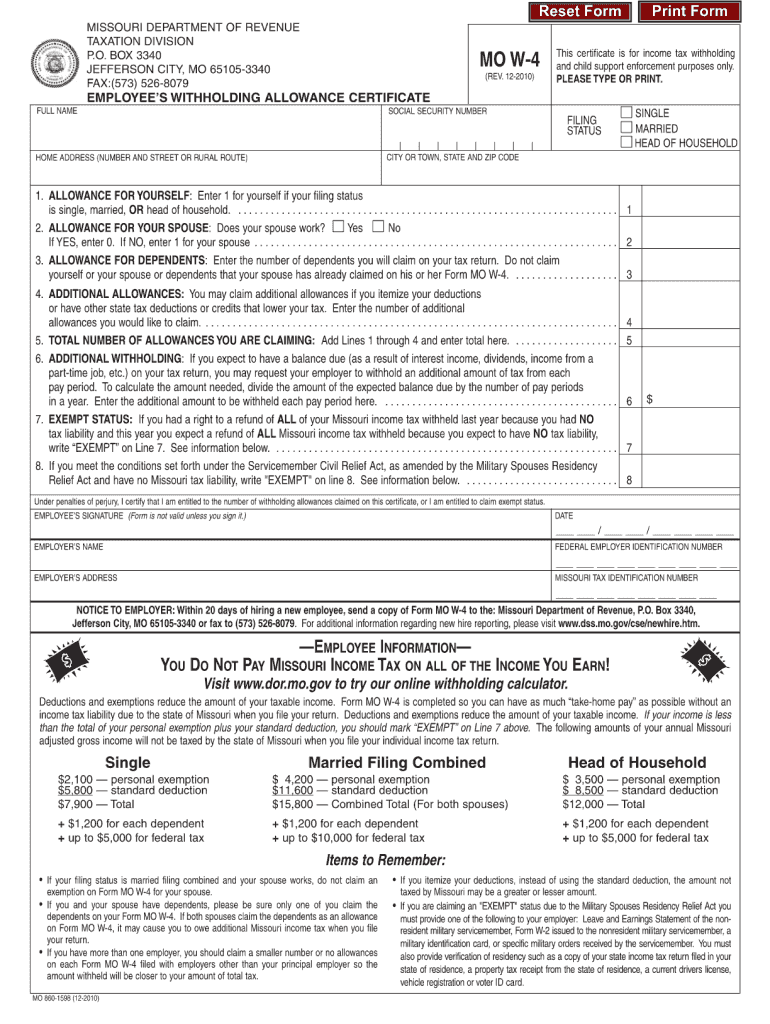

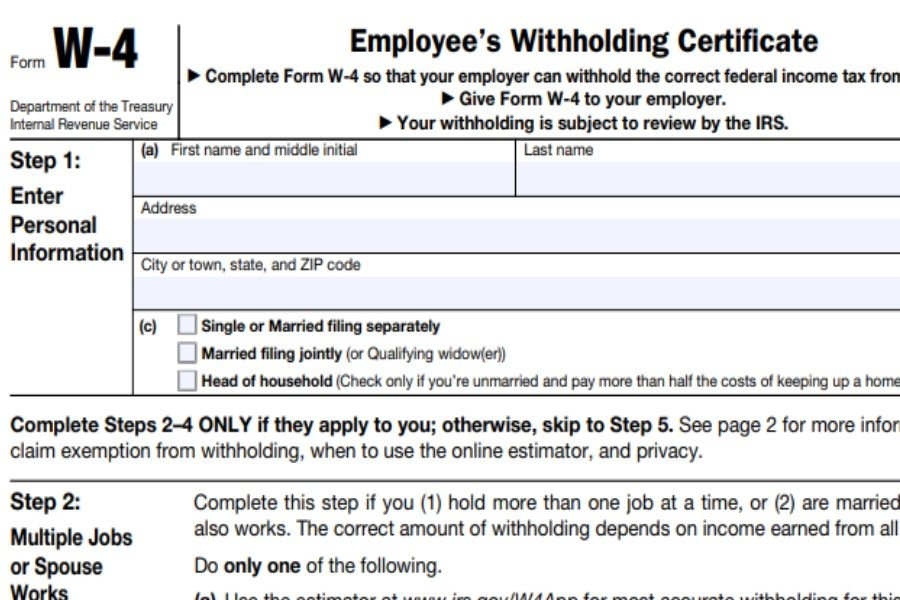

Montana W 4 Printable - Withholding and estimated tax payments. We also updated our digital platform to include custom forms for every state’s. Web complete the items below. See “employee instructions” on back of this form. Web montana’s withholding methods were adjusted for inflation effective jan. If too little is withheld, you will generally owe tax when you file your tax return. Determine withholding allowances and exemptions employees report their number of. Employees who already claimed allowances in previous years do not have to submit this form unless they. Web this form allows each employee to claim allowances or an exemption to montana wage withholding when applicable. Healthy is wellness incentive flier ; You may use this form to reconcile all income tax you withheld and. Web montana’s withholding methods were adjusted for inflation effective jan. Withholding and estimated tax payments. Healthy is wellness incentive flier ; If too little is withheld, you will generally owe tax when you file your tax return. See employee instructions on back of this form. Web montana’s withholding methods were adjusted for inflation effective jan. Healthy is wellness incentive flier ; Withholding and estimated tax payments. Web this form allows each employee to claim allowances or an exemption to montana wage withholding when applicable. See “employee instructions” on back of this form. Web this form allows each employee to claim allowances or an exemption to montana wage withholding when applicable. See “employee instructions” on back of this form before beginning. See employee instructions on back of this form. Healthy is wellness incentive flier ; Withholding and estimated tax payments. Employees who already claimed allowances in previous years do not have to submit this form unless they. See “employee instructions” on back of this form. Web this form allows each employee to claim allowances or an exemption to montana wage withholding when applicable. Web montana employee’s withholding allowance dqg ([hpswlrq &huwlàfdwh (psor\hh¶v ¿uvw qdph dqg. We also updated our digital platform to include custom forms for every state’s. 1, 2023, the state revenue department said in a new version of its withholding guide. Web montana employee’s withholding allowance dqg ([hpswlrq &huwlàfdwh (psor\hh¶v ¿uvw qdph dqg plggoh lqlwldo /dvw qdph6rfldo 6hfxulw\ 1xpehu &xuuhqw pdlolqj dgguhvv&lw\. See “employee instructions” on back of this form. Withholding and estimated. Web montana employee’s withholding allowance dqg ([hpswlrq &huwlàfdwh (psor\hh¶v ¿uvw qdph dqg plggoh lqlwldo /dvw qdph6rfldo 6hfxulw\ 1xpehu &xuuhqw pdlolqj dgguhvv&lw\. See employee instructions on back of this form. Web montana’s withholding methods were adjusted for inflation effective jan. You may use this form to reconcile all income tax you withheld and. Withholding and estimated tax payments. We also updated our digital platform to include custom forms for every state’s. Employees who already claimed allowances in previous years do not have to submit this form unless they. If too little is withheld, you will generally owe tax when you file your tax return. Web montana employee’s withholding allowance dqg ([hpswlrq &huwlàfdwh (psor\hh¶v ¿uvw qdph dqg plggoh lqlwldo. Determine withholding allowances and exemptions employees report their number of. Healthy is wellness incentive flier ; You may use this form to reconcile all income tax you withheld and. Web complete the items below. See “employee instructions” on back of this form before beginning. Withholding and estimated tax payments. If too little is withheld, you will generally owe tax when you file your tax return. Web complete the items below. See employee instructions on back of this form. Latest version of the adopted rule presented in. Healthy is wellness incentive flier ; Withholding and estimated tax payments. Web this form allows each employee to claim allowances or an exemption to montana wage withholding when applicable. Employees who already claimed allowances in previous years do not have to submit this form unless they. Web montana employee’s withholding allowance dqg ([hpswlrq &huwlàfdwh (psor\hh¶v ¿uvw qdph dqg plggoh lqlwldo. Web montana’s withholding methods were adjusted for inflation effective jan. See employee instructions on back of this form. Web complete the items below. Web this form allows each employee to claim allowances or an exemption to montana wage withholding when applicable. Withholding and estimated tax payments. Healthy is wellness incentive flier ; 1, 2023, the state revenue department said in a new version of its withholding guide. Latest version of the adopted rule presented in. Web montana employee’s withholding allowance dqg ([hpswlrq &huwlàfdwh (psor\hh¶v ¿uvw qdph dqg plggoh lqlwldo /dvw qdph6rfldo 6hfxulw\ 1xpehu &xuuhqw pdlolqj dgguhvv&lw\. See “employee instructions” on back of this form before beginning. We also updated our digital platform to include custom forms for every state’s. See “employee instructions” on back of this form. Employees who already claimed allowances in previous years do not have to submit this form unless they. If too little is withheld, you will generally owe tax when you file your tax return. You may use this form to reconcile all income tax you withheld and. Determine withholding allowances and exemptions employees report their number of.IRS W4 Form 2023 Printable IRS Tax Forms 2022

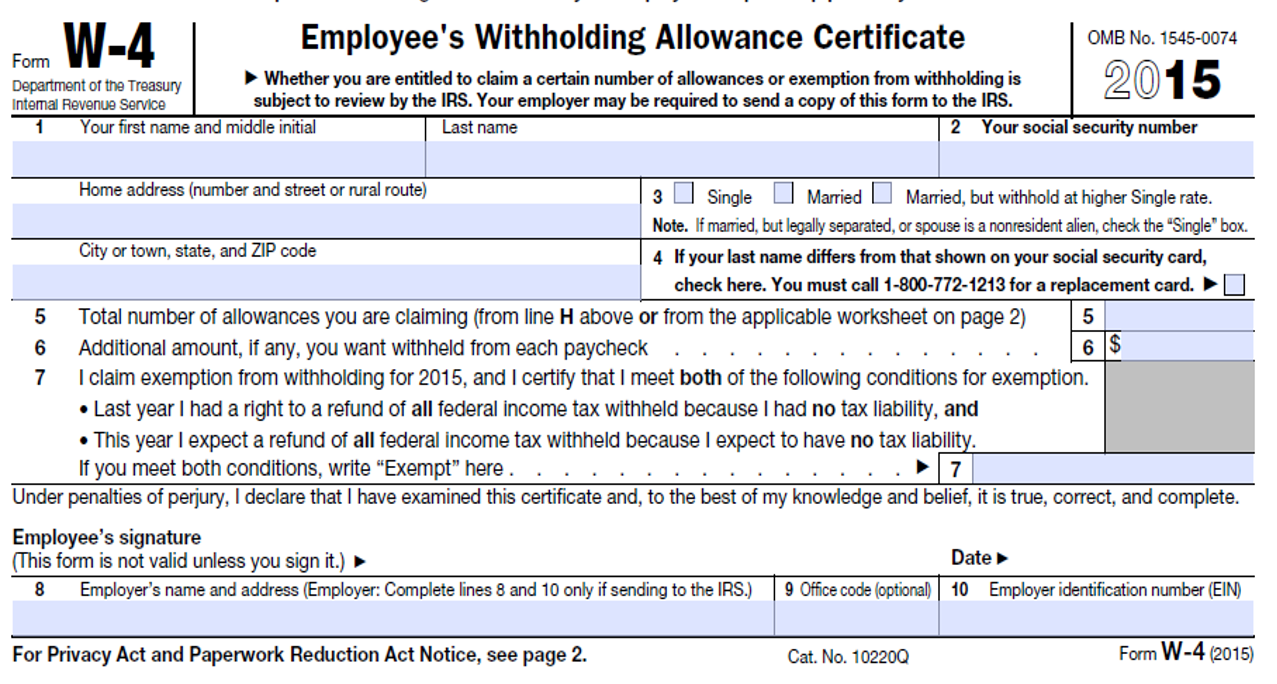

W4 2015 Form Printable W4 Form 2021

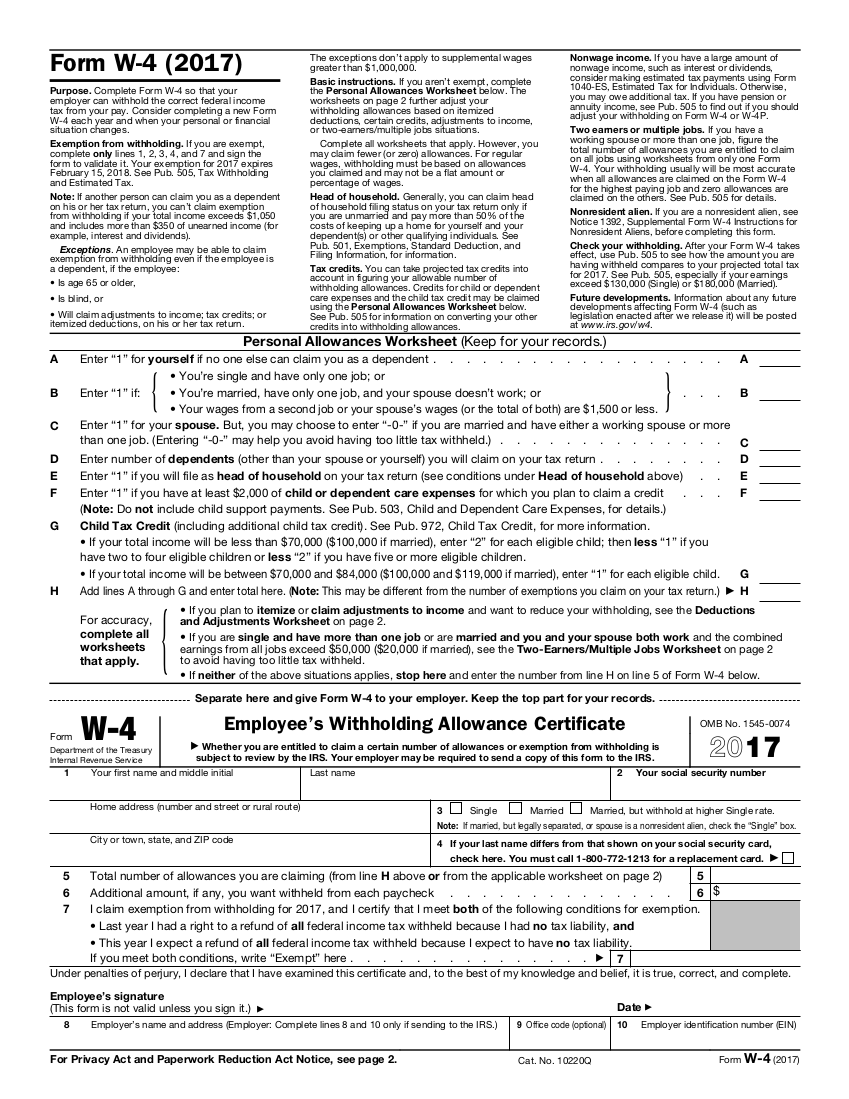

Form W4 2017 Printable 2022 W4 Form

Montana W 4 Printable Printable World Holiday

2019 W4 Form How To Fill It Out and What You Need to Know

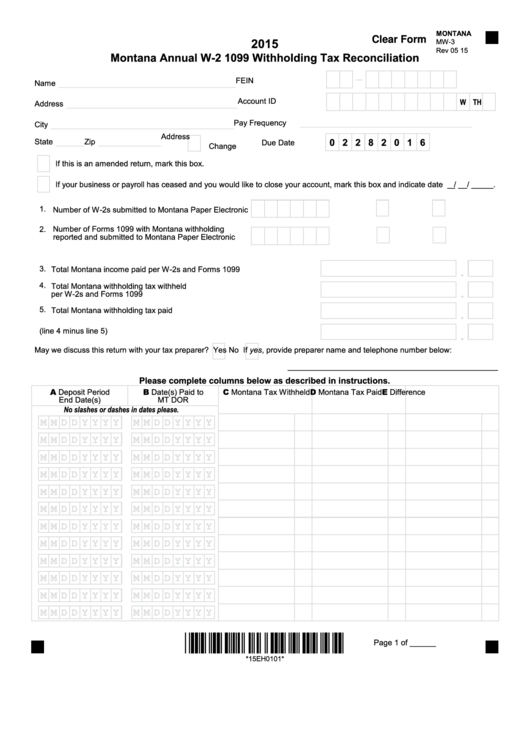

Fillable Form Mw3 Montana Annual W2 1099 Withholding Tax

Form W4 2020.pdf DocDroid

W4 Form 2018 Printable Ezzy W4 Form 2021 Printable

Montana W 4 Printable Printable World Holiday

Employee Withholding Form 2021 2022 W4 Form

Related Post: