Irs Form 843 Printable

Irs Form 843 Printable - Ad access irs tax forms. In response to an irs notice regarding a tax or fee related to certain taxes. Go to screen 61, claim of refund (843). Complete lines 1 through 3. Web mailing addresses for form 843. Web to request an abatement of interest on a tax, write “request for abatement of interest under section 6404 (e) ” at the top of form 843. Claim for refund and request for abatement (irs) form is 1 page long and contains: Form 843 doesn't offset any tax liability calculated on form 1040. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. Ad visit 2290asap online to print your irs stamped schedule 1 from your office! Ad access irs tax forms. Download your fillable irs form 843 in pdf. Web irs form 843 allows you to request a refund or abatement of certain taxes, interest, penalties, and fees. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. Ad visit 2290asap online to. Web see the instructions for form 843 for details on when to use this form. Web use form 843 if your claim or request involves: Complete lines 1 through 3. You should use this form if you have incurred penalties due to. Taxpayers hate paying irs penalties. If you are filing form 843. Complete lines 1 through 3. Complete, edit or print tax forms instantly. If the erroneous advice does not relate to an item on a federal tax return, form 843 should be. Ad grab great deals and offers on forms & recordkeeping items at amazon. If the erroneous advice does not relate to an item on a federal tax return, form 843 should be. Claim for refund and request for abatement (irs) form is 1 page long and contains: Web use form 843 if your claim or request involves: Web information about form 843, claim for refund and request for abatement, including recent updates, related. Web to request an abatement of interest on a tax, write “request for abatement of interest under section 6404 (e) ” at the top of form 843. In response to an irs notice regarding a tax or fee related to certain taxes. Complete lines 1 through 3. Check the box, print form 843 with complete return. If the erroneous advice. If you are filing form 843. (a) a refund of one of the taxes (other than income taxes or an employer’s claim for fica tax, rrta tax, or income tax withholding). Web to generate form 843: Then mail the form to…. If you had more than one railroad employer and more than $5,821.20 in tier. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. See the form 1040 instructions. Web form 843, claim for refund and request for abatement. Ad access irs tax forms. (a) a refund of one of the taxes (other than income taxes or an employer’s claim for. See the form 1040 instructions. Get deals and low prices on irs form 1099 nec at amazon Form 843 doesn't offset any tax liability calculated on form 1040. If you had more than one railroad employer and more than $5,821.20 in tier. In response to an irs notice regarding a tax or fee related to certain taxes. If the erroneous advice does not relate to an item on a federal tax return, form 843 should be. Web mailing addresses for form 843. Web see the instructions for form 843 for details on when to use this form. See the form 1040 instructions. Ad grab great deals and offers on forms & recordkeeping items at amazon. Get ready for tax season deadlines by completing any required tax forms today. Claim for refund and request for abatement (irs) form is 1 page long and contains: If the erroneous advice does not relate to an item on a federal tax return, form 843 should be. Ad access irs tax forms. (a) a refund of one of the taxes. Web form 843, claim for refund and request for abatement. Scroll down to the claim/request information. Web to request an abatement of interest on a tax, write “request for abatement of interest under section 6404 (e) ” at the top of form 843. If the erroneous advice does not relate to an item on a federal tax return, form 843 should be. (a) a refund of one of the taxes (other than income taxes or an employer’s claim for fica tax, rrta tax, or income tax withholding). Unfortunately, most taxpayers assessed an irs penalty do not request relief or are. Claim for refund and request for abatement (irs) form is 1 page long and contains: Ad visit 2290asap online to print your irs stamped schedule 1 from your office! More about the federal form 843. Form 843 doesn't offset any tax liability calculated on form 1040. If you had more than one railroad employer and more than $5,821.20 in tier. Complete, edit or print tax forms instantly. Web see the instructions for form 843 for details on when to use this form. If you are filing form 843 to claim a. If you are filing form 843. In response to an irs notice regarding a tax or fee related to certain taxes. Get ready for tax season deadlines by completing any required tax forms today. A refund of one of the taxes (other than. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. Web use form 843 if your claim or request involves:Irs 1040 Form Form1040allpages PriorTax Blog Form 1040 is how

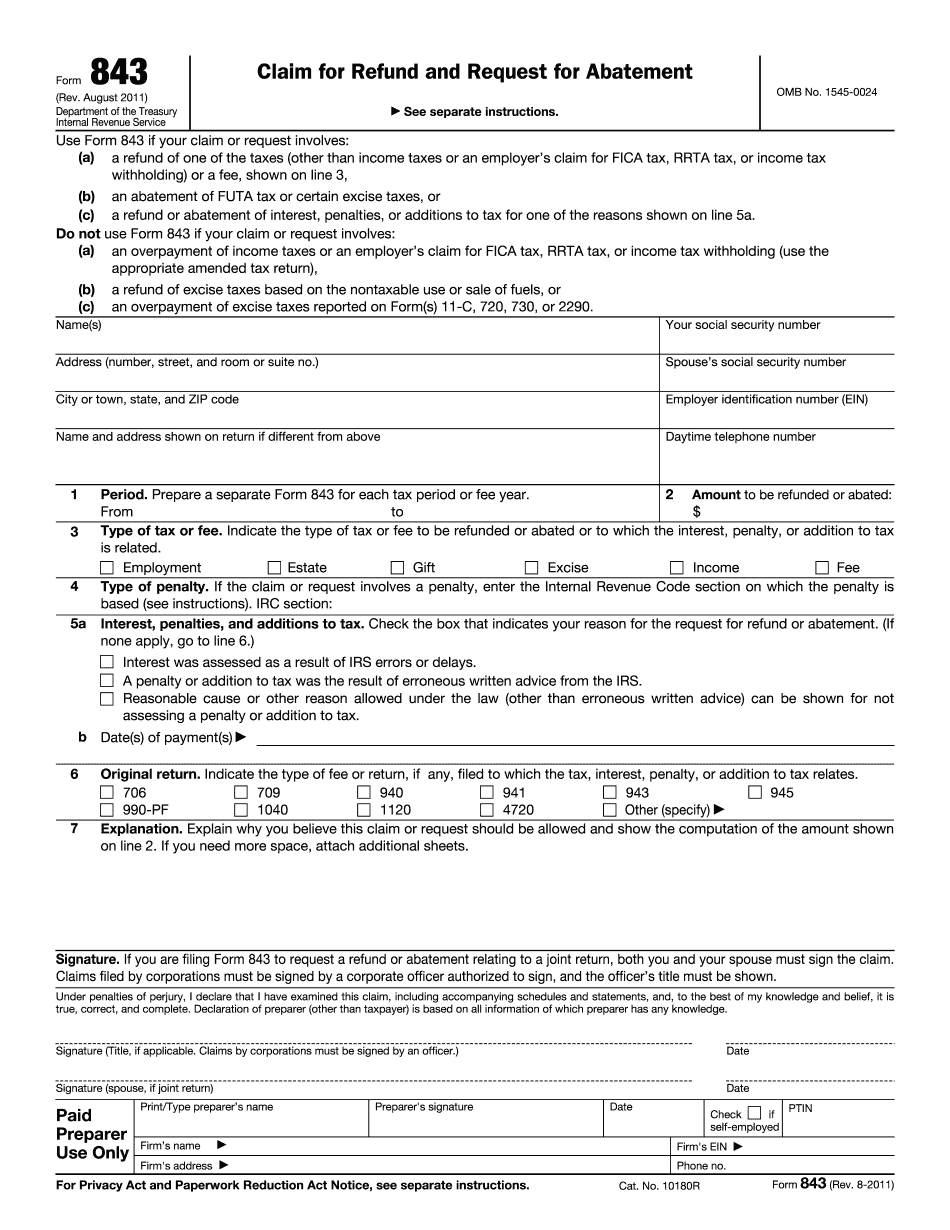

Form 843 Claim for Refund and Request for Abatement (2011) Free Download

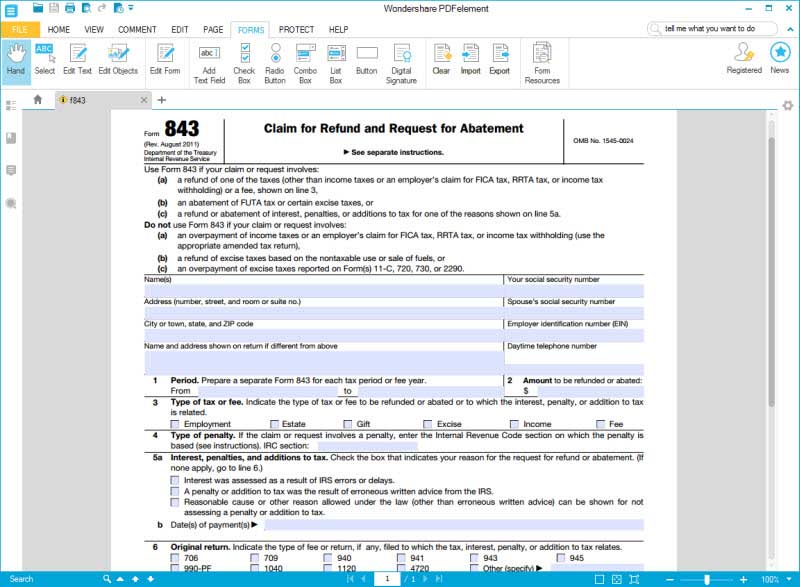

Irs Form 843 Fillable Pdf Printable Forms Free Online

Irs Form 843 Fillable and Editable PDF Template

Irs Forms Printable 2019 Form Resume Examples Mj1vkXNKwy

Irs Form Fill Out and Sign Printable PDF Template signNow

Form 843, Claim for Refund and Request for Abatement IRS Fill

IRS Form 843 Instructions Irs Tax Forms Tax Refund

Irs Form 843 Printable Printable Forms Free Online

Std 843 Rev 5 2006 Fill and Sign Printable Template Online US Legal

Related Post: