Free Printable Debt Snowball Worksheet

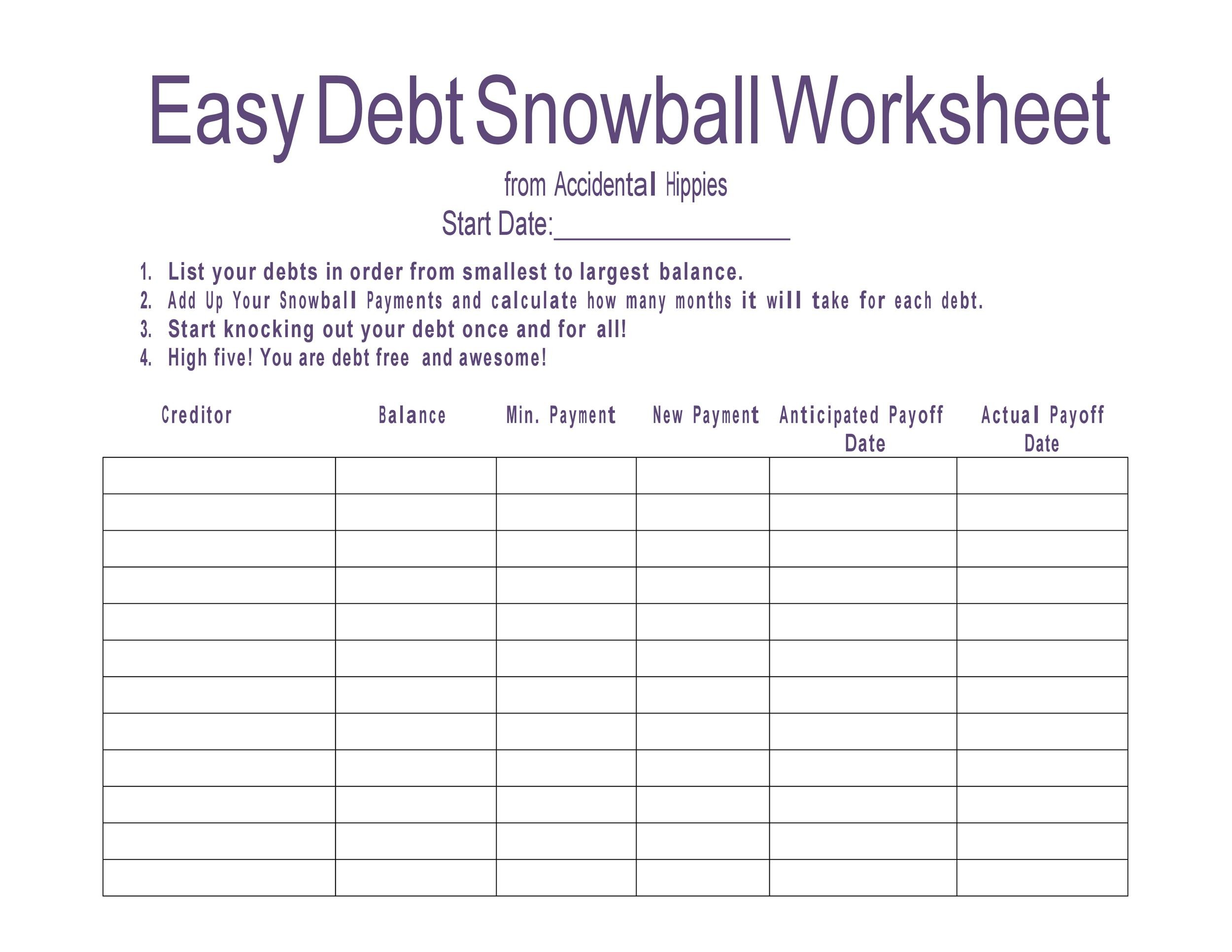

Free Printable Debt Snowball Worksheet - Pay the minimum payment for all your debts except for the smallest one. $1,000 ($50 minimum payment) 2nd debt: Web a debt snowball spreadsheet is a tool used in this popular method for paying off debt. It lists all debt in ascending order by balance owed and includes the minimum payments due. Tiller money offers several types of spreadsheets including a debt. Web credit card debt 1: With the snowball method, you always start with the lowest payment first. You focus on your lowest balance debt first, while paying only the minimum payments on all other debts. Web with the debt snowball method, you simply start with the smallest debt first, and so you would order them accordingly: Do the same for the second smallest debt untill that one is paid off as well. You need to work out how much you can put towards this first debt while covering the minimum payments. Web this free printable debt snowball worksheet set will make paying down your debt simple and easy to understand. Tiller money is a budgeting tool that can help you manage your money and pay off your debt. Web free printable debt. The debt snowball method is a popular strategy for paying off debt that involves focusing on paying off smaller debts first, while still making minimum payments on larger debts. Web free printable debt snowball templates [pdf, excel] worksheet. $3,000 ($70 minimum payment) 4th debt: Web a debt snowball spreadsheet is a tool used in this popular method for paying off. Web this free printable debt snowball worksheet set will make paying down your debt simple and easy to understand. $3,000 ($70 minimum payment) 4th debt: $2,000 ($65 minimum payment) 3rd debt: Web these free printable pdf debt snowbal concept worksheets will help you track your progress through dave ramsey's debt snowball method. Put any extra dollar amount into your smallest. List all of your debts smallest to largest, and use this sheet to mark them off one by one. I first learned about the debt snowball method from reading a dave ramsey book and from his. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. Web free printable debt snowball templates. The debt snowball is one of the best ways to make a big dent in your outstanding debts. Why the debt snowball works so well. Invest 15% of your household income in retirement. Do the same for the second smallest debt untill that one is paid off as well. This is the tool that got me there. Why the debt snowball works so well. Web snowball worksheet debt list all your debts below starting from the smallest to the largest balance. Pay the minimum payment for all your debts except for the smallest one. Web this is the fun one! The debt snowball method focuses on paying one debt off at a time. $4,000 ($75 minimum payment) for example, let's say you have $1,000 to pay towards. Web best free debt snowball spreadsheet for excel to download in 2023. $1,000 ($50 minimum payment) 2nd debt: Web this is the fun one! With the snowball method, you always start with the lowest payment first. List all of your debts smallest to largest, and use this sheet to mark them off one by one. In this case, it would be credit card debt number 1. Web these free printable pdf debt snowbal concept worksheets will help you track your progress through dave ramsey's debt snowball method. This is the tool that got me there. You. $3,000 ($70 minimum payment) 4th debt: The debt snowball method focuses on paying one debt off at a time. You focus on your lowest balance debt first, while paying only the minimum payments on all other debts. Get your debt snowball rolling. Web credit card debt 1: Put any extra dollar amount into your smallest debt until it is paid off. Do the same for the second smallest debt untill that one is paid off as well. Web free printable debt snowball templates [pdf, excel] worksheet. With the snowball method, you always start with the lowest payment first. Web this free printable debt snowball worksheet set will. $2,000 ($65 minimum payment) 3rd debt: Tiller money is a budgeting tool that can help you manage your money and pay off your debt. Web these free printable pdf debt snowbal concept worksheets will help you track your progress through dave ramsey's debt snowball method. Web a debt snowball spreadsheet is a tool used in this popular method for paying off debt. In this case, it would be credit card debt number 1. Web with the debt snowball method, you simply start with the smallest debt first, and so you would order them accordingly: The debt snowball method is a popular strategy for paying off debt that involves focusing on paying off smaller debts first, while still making minimum payments on larger debts. Invest 15% of your household income in retirement. Web this is the fun one! The debt snowball method focuses on paying one debt off at a time. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. Save for your children’s college fund. Web credit card debt 1: Web this free printable debt snowball worksheet set will make paying down your debt simple and easy to understand. The debt snowball is one of the best ways to make a big dent in your outstanding debts. List all of your debts smallest to largest, and use this sheet to mark them off one by one. Web snowball worksheet debt list all your debts below starting from the smallest to the largest balance. $4,000 ($75 minimum payment) for example, let's say you have $1,000 to pay towards. What is a debt snowball? With the snowball method, you always start with the lowest payment first.Free Debt Snowball Printable Worksheet Track Your Debt Payoff

Free Printable Debt Snowball Worksheet Pay Down Your Debt!

Free Debt Snowball Printable Worksheets Simplistically Living

Free Debt Snowball Method Worksheet Simply Unscripted

38 Debt Snowball Spreadsheets, Forms & Calculators

Free Printable Snowball Debt Spreadsheet Printable Blank World

Free Debt Snowball Worksheet Printable Vital Dollar

Free Debt Snowball Worksheet Crush Your Debt Faster Debt snowball

Free Printable Debt Snowball Worksheet Printable

Debt Snowball Worksheet Budget Printable Etsy Budgeting finances

Related Post: