Form 8962 Printable

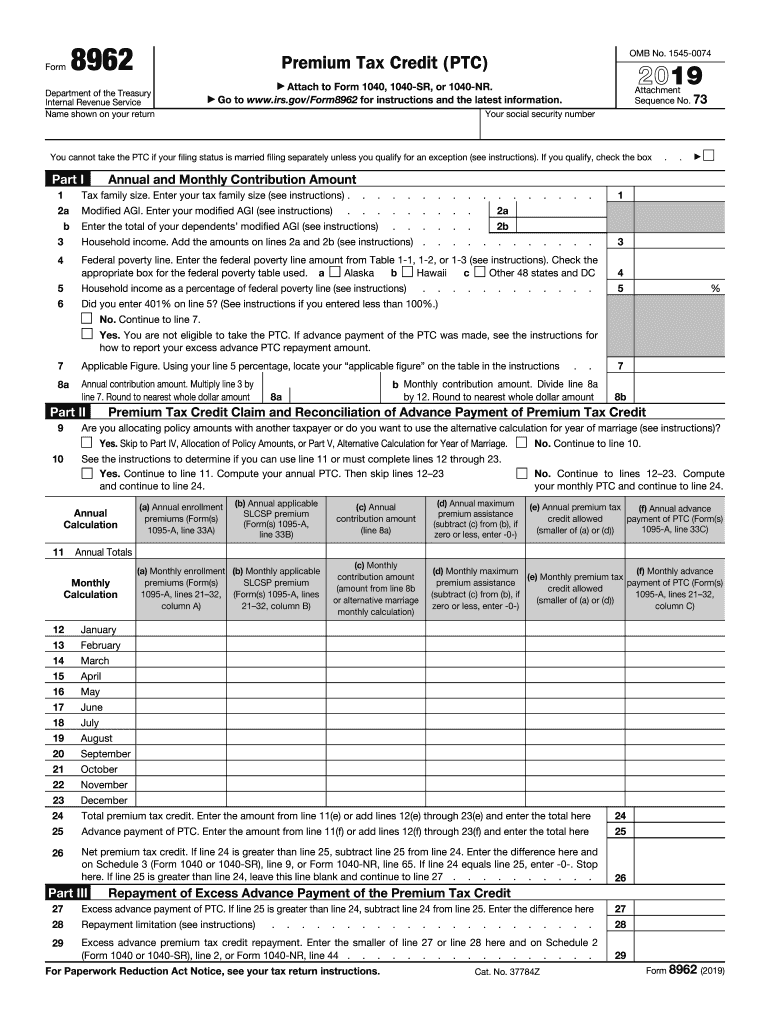

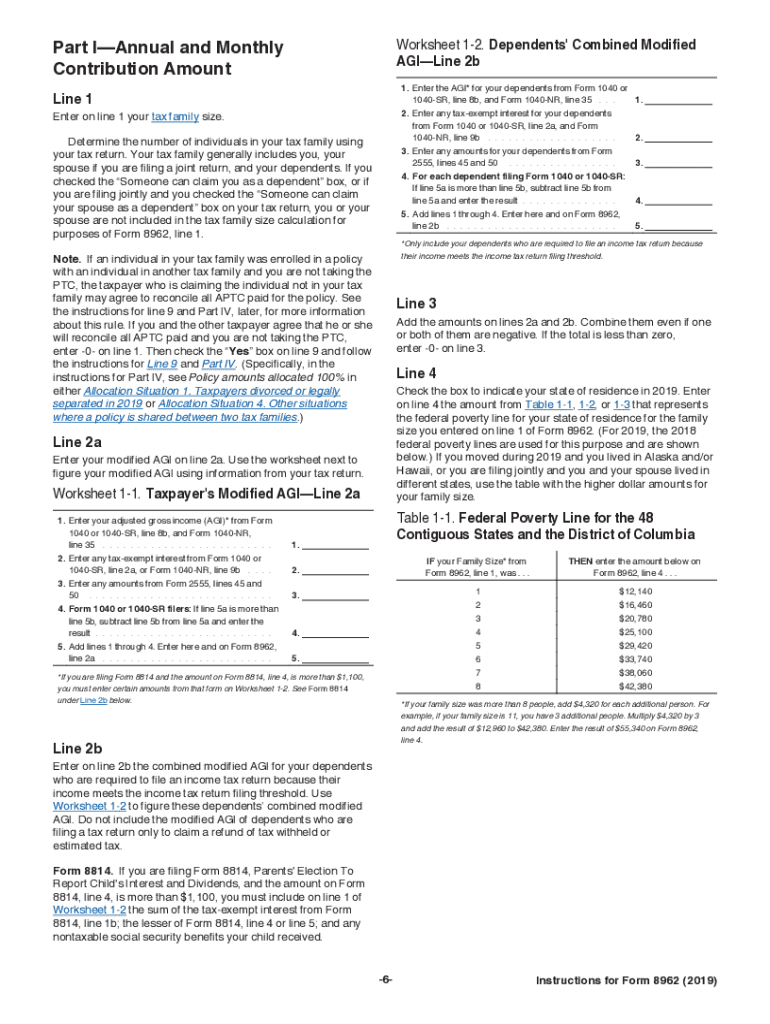

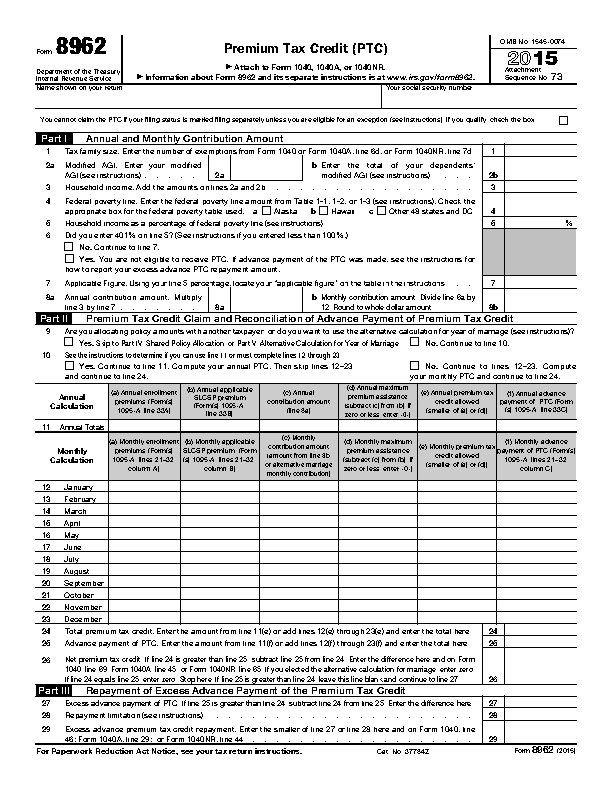

Form 8962 Printable - By checking this box, you consent to our data privacy policy. This form is only used by taxpayers who. Web get irs form 8962 for the current year. Form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace. Premium tax credit (ptc) department of the treasury internal revenue service. Web instructions for form 8962. Firstly, ensure your eligibility and need for the form. Web irs form 8962 if you are claimed as somebody’s dependent, then you aren't eligible for the premium tax credit, and you do not file according to instructions for 8962 tax form. You must file tax return for 2022 if enrolled in health insurance marketplace®. Section references are to the internal revenue code unless otherwise. Section references are to the internal revenue code unless otherwise. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. You. You can download or print current or past. Enter personal information shown on your tax return. Web get irs form 8962 for the current year. Web use form 8962 to “reconcile” your premium tax credit — compare the amount you used in 2021 to lower your monthly insurance payment with the actual premium tax credit you. Section references are to. Firstly, ensure your eligibility and need for the form. Your tax family size, form 8962, line 1, does not match your family size reflected on page 1 of. Section references are to the internal revenue code unless otherwise. Web get irs form 8962 for the current year. Section references are to the internal revenue code unless otherwise. Calculate the annual and monthly. Web filling out blank printable 8962 form. Web how to file. It is primarily for those who availed of premium tax credit (ptc), but check the 2022. Web instructions for form 8962. Web instructions for form 8962. This form is only used by taxpayers who. To open the printable form 8962 click the fill out form button. You may take ptc (and aptc may. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Web instructions for form 8962. You can download or print current or past. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax. Web form 8962, premium tax credit if you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with. Web irs form 8962 if you are claimed as somebody’s dependent, then you aren't eligible for the premium tax credit, and you do not file according to instructions for 8962. Simply follow the link on our website to open the pdf file and opt for the print option. Premium tax credit (ptc) department of the treasury internal revenue service. Your tax family size, form 8962, line 1, does not match your family size reflected on page 1 of. Web irs form 8962 if you are claimed as somebody’s dependent, then. This form is only used by taxpayers who. Calculate the annual and monthly. You must file tax return for 2022 if enrolled in health insurance marketplace®. Section references are to the internal revenue code unless otherwise. You can download or print current or past. By checking this box, you consent to our data privacy policy. This form is only used by taxpayers who. It is primarily for those who availed of premium tax credit (ptc), but check the 2022. Your tax family size, form 8962, line 1, does not match your family size reflected on page 1 of. The premium tax credit took effect. This form is only used by taxpayers who. Firstly, ensure your eligibility and need for the form. Section references are to the internal revenue code unless otherwise. Web how to file. Web filling out blank printable 8962 form. Enter personal information shown on your tax return. Check out our premium tax credit guides for. Web form 8962, premium tax credit if you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. By checking this box, you consent to our data privacy policy. Section references are to the internal revenue code unless otherwise. Premium tax credit (ptc) department of the treasury internal revenue service. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). You may take ptc (and aptc may. Web use form 8962 to “reconcile” your premium tax credit — compare the amount you used in 2021 to lower your monthly insurance payment with the actual premium tax credit you. To open the printable form 8962 click the fill out form button. Premium tax credit (ptc) department of the treasury internal revenue service. Web irs form 8962 if you are claimed as somebody’s dependent, then you aren't eligible for the premium tax credit, and you do not file according to instructions for 8962 tax form. Form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace. It is primarily for those who availed of premium tax credit (ptc), but check the 2022.Fillable 8962 Tax Form Printable Forms Free Online

Publication 974 (2021), Premium Tax Credit (PTC) Internal Revenue Service

8962 Form Fill Out and Sign Printable PDF Template signNow

How To Fill Out Form 8962 laurasyearinhongkong

2014 federal form 8962 instructions

form 8962 2014 Diy Menu Cards, Menu Card Template, Wedding Menu

Example of Form 8962 filled out Fill online, Printable, Fillable Blank

8962 Form Fill Out and Sign Printable PDF Template signNow

Irs Form 8962 For 2016 Printable Master of Documents

Best IRS 8962 For 2015 (US) 2019 Update FormsPro.io

Related Post: