Convenience Fee Printable Credit Card Fee Sign

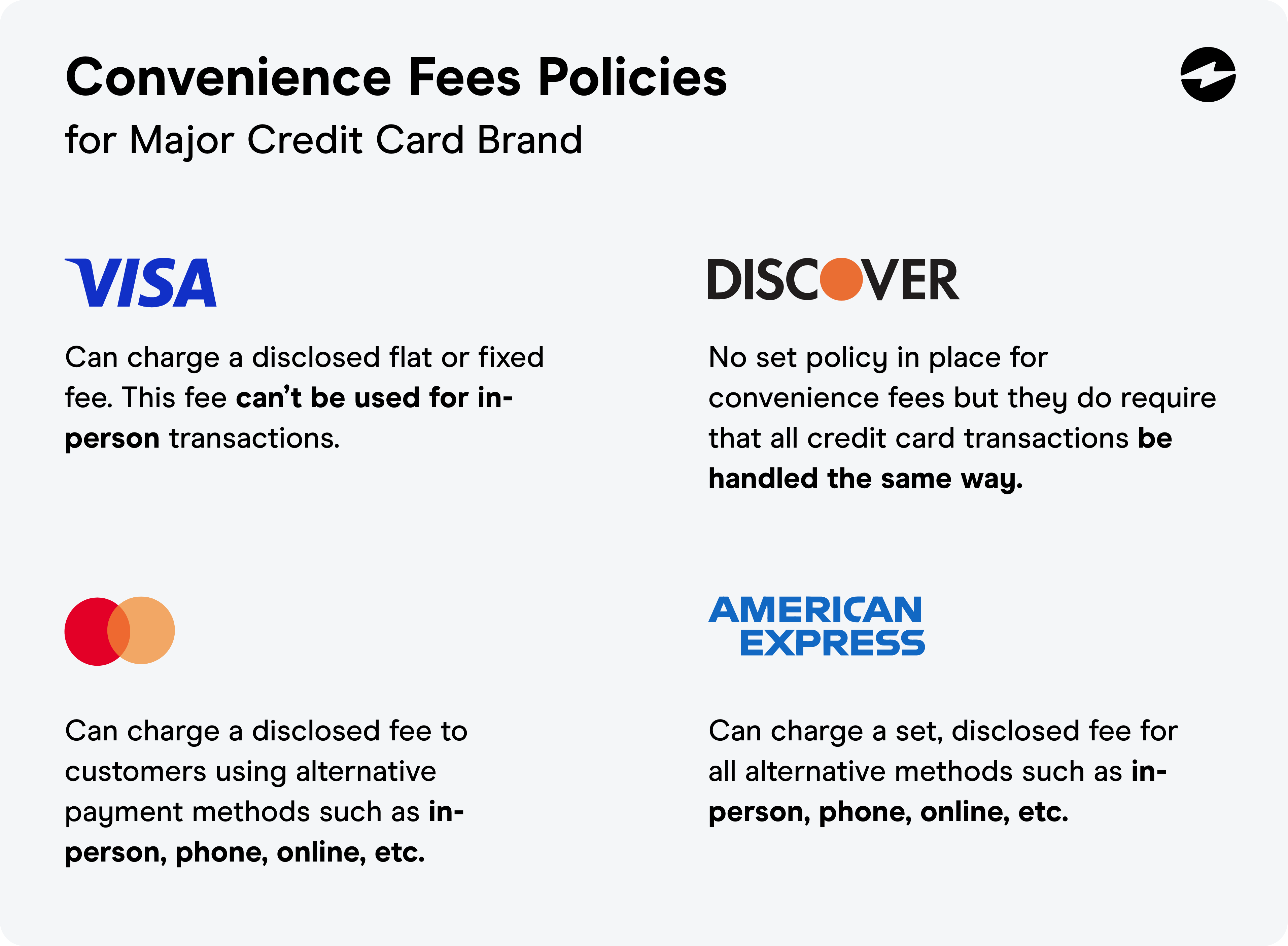

Convenience Fee Printable Credit Card Fee Sign - Convenience fees may be worth paying if you use your card enough to earn rewards. 5% of each balance transfer; Web while there are rules on how you can charge convenience fees, they vary by credit card company. Visa, for example, allows convenience fees if your customers. Web how do i add in a convenience fee for paying by credit card? Web credit card surcharges are optional fees added by a merchant when customers use a credit card to pay at checkout. Web currently, the ability to add a convenience fee for paying by credit card is not available in quickbooks online. Web $0 read review learn more what is a convenience fee? Web how do credit card convenience fees work? American express blue business plus credit card. Web balance transfer fee: Web best 0% apr business credit cards. While credit card convenience fees are added on for completing a transaction remotely — like online, via mobile app or over. Credit card processing companies ordinarily forbid charging a surcharge for accepting cards, but, under limited circumstances, they do permit a convenience. Web the convenience fee must appear as. While credit card convenience fees are added on for completing a transaction remotely — like online, via mobile app or over. Web how do credit card convenience fees work? Program merchants must obtain separate authorizations and approval codes. American express blue business plus credit card. Visa, for example, allows convenience fees if your customers. Web june 7, 2022, at 9:00 a.m. American express blue business plus credit card. The citi custom cash® card also offers an. While credit card convenience fees are a nuisance and an additional expense for consumers, businesses. Best for no annual fee: Web the convenience fee must appear as two separate charges on the cardmember’s statement. Web currently, the ability to add a convenience fee for paying by credit card is not available in quickbooks online. American express blue business plus credit card. Here in august 2022, and looks like qb refuses to address this issue that is costing their. Web how. Web types of credit card fees that could be leveraged to reduce the cost of processing credit card payments. Convenience fees may be worth paying if you use your card enough to earn rewards. Surcharges are legal unless restricted. Web convenience fees vs. Credit card processing companies ordinarily forbid charging a surcharge for accepting cards, but, under limited circumstances, they. Web convenience fees vs. Web currently, the ability to add a convenience fee for paying by credit card is not available in quickbooks online. Web credit card surcharging enables a business to charge an additional fee (up to a maximum of 4% of the total transaction) when a customer pays with a credit card. Here in august 2022, and looks. Surcharges are legal unless restricted. American express blue business plus credit card. Web best 0% apr business credit cards. As a workaround, you would need to create a. Web balance transfer fee: Web types of credit card fees that could be leveraged to reduce the cost of processing credit card payments. Here in august 2022, and looks like qb refuses to address this issue that is costing their. Web convenience fees vs. Web credit card surcharges are optional fees added by a merchant when customers use a credit card to pay at. Best for no annual fee: Credit card processing companies ordinarily forbid charging a surcharge for accepting cards, but, under limited circumstances, they do permit a convenience. Surcharges are legal unless restricted. What is a convenience fee? Web credit card surcharging enables a business to charge an additional fee (up to a maximum of 4% of the total transaction) when a. Convenience fees may be worth paying if you use your card enough to earn rewards. American express blue business plus credit card. While credit card convenience fees are added on for completing a transaction remotely — like online, via mobile app or over. Web convenience fees vs. Web june 7, 2022, at 9:00 a.m. American express blue business plus credit card. Web balance transfer fee: Web convenience fees vs. As you look to maximize your credit. Web manually add the fee as a separate line item on each invoice we send (added fee gets a fee so calculated amount doesn’t cover fee total) or send a second invoice to. Visa, for example, allows convenience fees if your customers. (getty images) a convenience fee is added to a transaction. Web june 7, 2022, at 9:00 a.m. Web $0 read review learn more what is a convenience fee? Program merchants must obtain separate authorizations and approval codes. Web types of credit card fees that could be leveraged to reduce the cost of processing credit card payments. Credit card processing companies ordinarily forbid charging a surcharge for accepting cards, but, under limited circumstances, they do permit a convenience. Web how do i add in a convenience fee for paying by credit card? The citi custom cash® card also offers an. Best for no annual fee: As a workaround, you would need to create a. Here in august 2022, and looks like qb refuses to address this issue that is costing their. Ink business unlimited® credit card. 5% of each balance transfer; Surcharges are legal unless restricted.Guide On Charging Credit Card Convenience Fees PDCflow Blog

Town Treasurer Highgate, Vermont

Guide On Charging Credit Card Convenience Fees PDCflow Blog

Cash Discount Program Credit Card Processing Leap Payments

Facebook

Credit card fees at trendy restaurants are new on menus

Village Hall Archives Village of Third LakeVillage of Third Lake

Passing Credit Card Fees to Customers

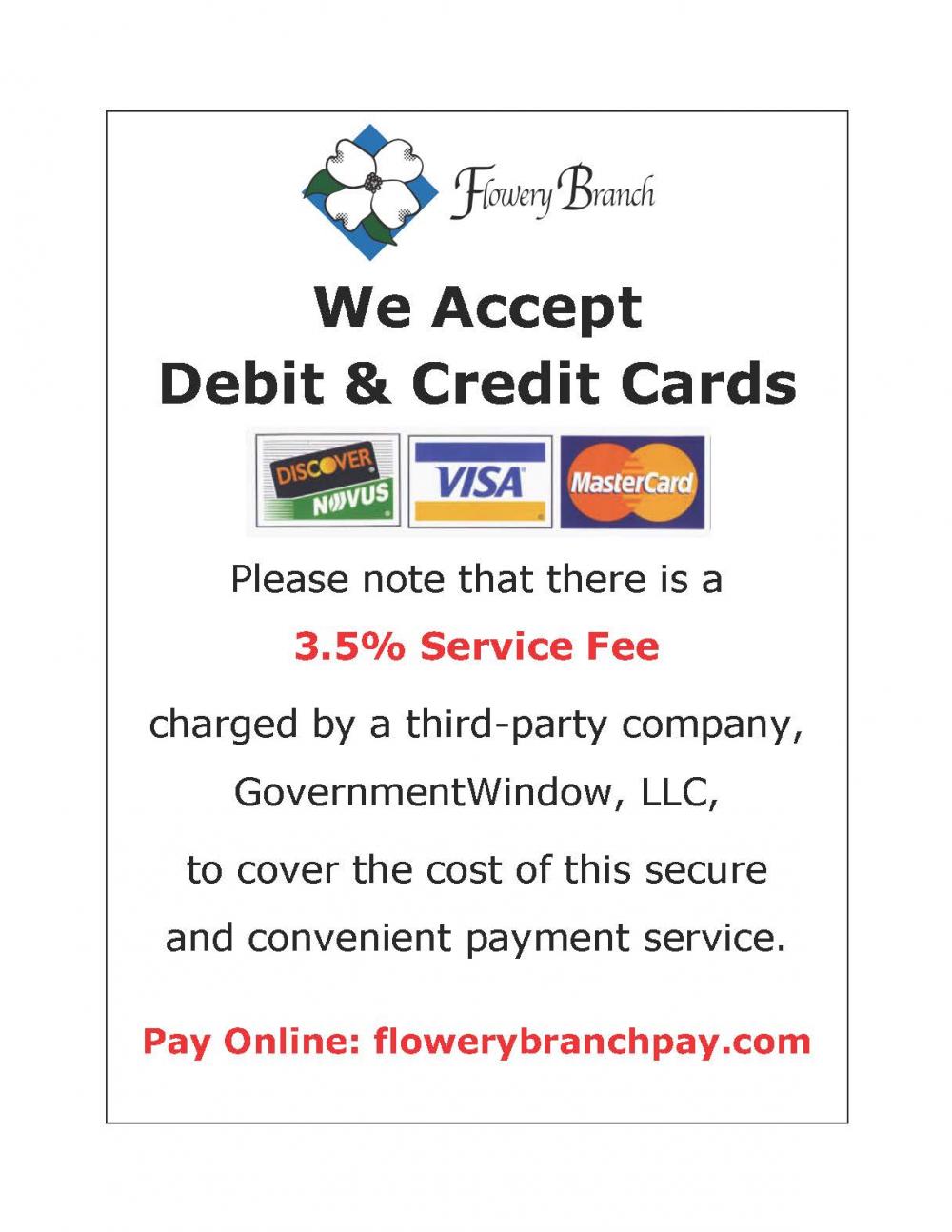

NOTICE NEW CREDIT CARD FEES City of Flowery Branch,

Convenience Fees and the Fair Debt Collection Practices Act

Related Post:

.jpg)